Covering Student Loan Debt Relief

How Local Journalists Can Help Their Audience Make Sense Of It

President Biden signed a new $300 Billion executive order this week. Some financial experts say the real numbers for Student Loan Debt Relief may actually be double that amount — which would be more than half-a-trillion dollars. Add that to all of the other recent federal government programs, and taxpayers are looking at additional spending of several trillion dollars. Journalists have a lot of work to do to cover these stories well.

Most of the coverage I’m seeing and reading from local stations and newspapers is coming from national reporting (e.g. network reporters, national writers). That’s okay for the early days of covering a big story, but local journalists need to cover a story of this magnitude from the local perspective that only they can give.

Real People

Talking with economic and financial experts is fine, but don’t forget to talk with real people in your community. What I mean by “real people” is people on the street (POS). You’ll find them in your neighborhood, at school board meetings, city council meetings, at the supermarket, shopping downtown, at the mall, etc.

Yes, report their reaction to the loan forgiveness program (loan debt relief), but also find some real people willing to allow you to follow them through their process of getting their student loan relief. Find real people who already paid off their student loans and show what sacrifices they made to do that. How long did it take them? What did they not buy because they used their money to pay off their loans? People need to hear more than huge numbers — they need to see how government decisions affect real lives.

One question many parents are asking is whether the loans they took out to help pay for their children to go to college will be eligible for loan forgiveness (Parent PLUS Loans). If so, what’s their process for getting the money? If not, how does that affect them? Will they make any changes to their children’s current or future education based on the government’s decision?

Another question people are asking is about eligibility. How do they determine it? When will they know for sure? What if they get a raise in pay while they’re waiting to get the paperwork finished that pushes them over the limit? Will that affect their ability to get loan debt relief?

Real people also want to know why colleges and universities are not participating in student loan debt relief. Why don’t institutions of higher learning help pay for the loan relief? Parents also wonder why college tuitions have increased faster than inflation for many years. Pass along parent questions to local college administrators to get their reaction.

President Biden said student debt relief (student loan forgiveness) is “fair.”

I find it interesting how some of my Republican friends who voted for those tax cuts and others think that we shouldn’t be helping these folks. Some think it’s too little. But I believe my plan is responsible and fair. It focuses the benefit on middle-class and working families, it helps both current and future borrowers, and it will fix a badly broken system. Remarks by President Biden Announcing Student Loan Debt Relief Plan

Is that what people are saying in your community? Do they view it as fair? If they don’t think it’s fair, what do they think should be done about it? If they do think it’s fair, ask them why they think that.

Many people who worked hard to pay off their student loans and the loans of their children are asking tough questions — so should you. Many people who went into job careers that didn’t need a college degree also wonder how the loan forgiveness is fair. Do they think it’s fair for their tax dollars to help pay off the loans of people who did go to college when they chose to take a different career path? Do they think the government should do something to help them financially as well?

What about the future? Does this loan debt relief program set a precedent? Will students and their parents expect loan debt relief to continue every year for years to come?

President Biden said the debt relief plan will benefit “middle-class and working families.” That’s something you can cover by staying in close touch with government representatives and financial experts. They should be able to confirm who gets the debt relief money.

You might also report how the government defines the terms — “middle-class” and “working” families. Then, check their definition with other sources in your community. What is a middle-class family? What is a working family? What kind of jobs do those people work? What’s their average family income? Are the majority of people receiving the loan forgiveness on the high side of the income limit? low side? in the middle? a mix of all three?

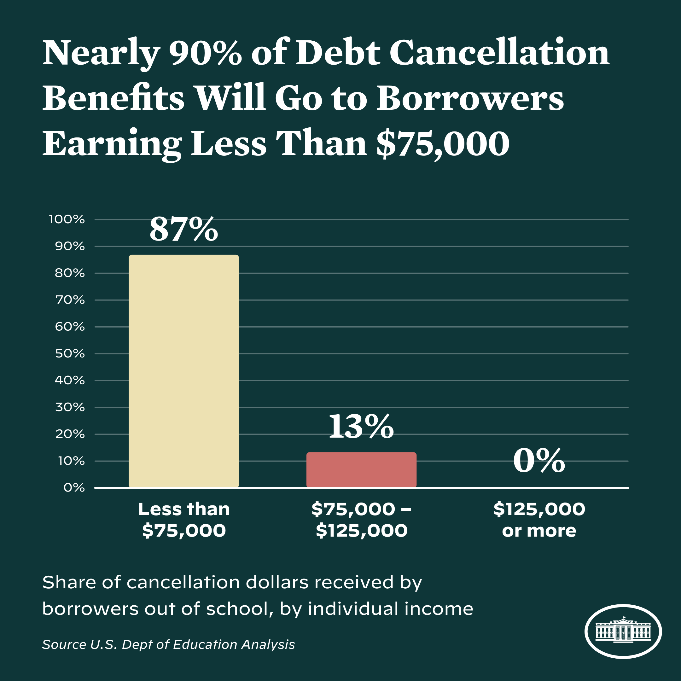

The U.S. Department of Education claims —

Is that true? It’s something you can follow closely in your community. Be sure to talk with everyone from every side of this big story. Talk with the experts. Talk with real people. Stay on top of this story. Update it regularly. Report about deadlines. Follow the real people who agree to help you with your ongoing story. Update their situation often enough that your audience doesn’t forget about them or the story. Keep the personal part of the story in front of your audience, even as you do the financial side.

Next Newsletter

Spending on “climate change” is a huge part of the Inflation Reduction Act of 2022. We will look at ways of covering that big story in the next newsletter.

Comments

I hope these thoughts are helpful to you as a journalist or news consumer. Please share your comments and I’ll respond as quickly as I can. If you like what we’re doing in this newsletter, please let your friends know about it so they can subscribe.

Newsletter Purpose

The purpose of this newsletter is to help journalists understand how to do real journalism and the public know how they can find news they can trust on a daily basis. It’s a simple purpose, but complicated to accomplish. I’ll do my best to make it as clear as I can in future newsletters.

1960s Radio News, © Mark McGee